Wait for spreads to rise before investing in corporate bonds: Puneet Pal of PGIM MF - The Economic Times

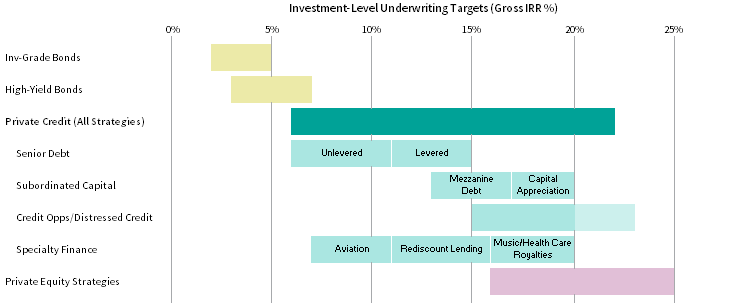

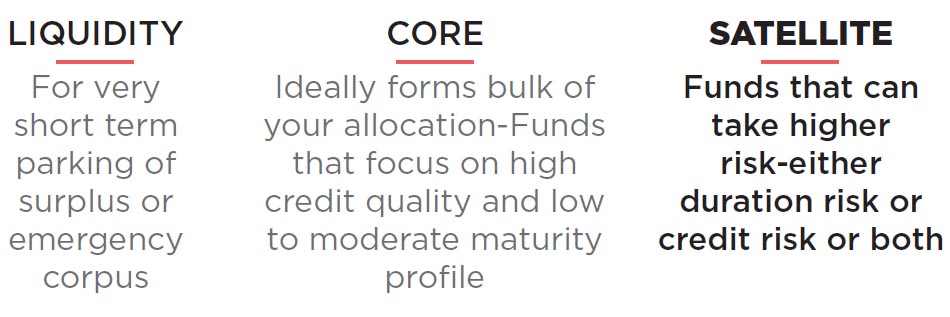

BernCoTreasurer on Twitter: "Once those two priorities are met, we focus on getting the highest return possible. Currently, we divide our portfolio into three “buckets,” or components: https://t.co/OMjlQKbS9r" / Twitter

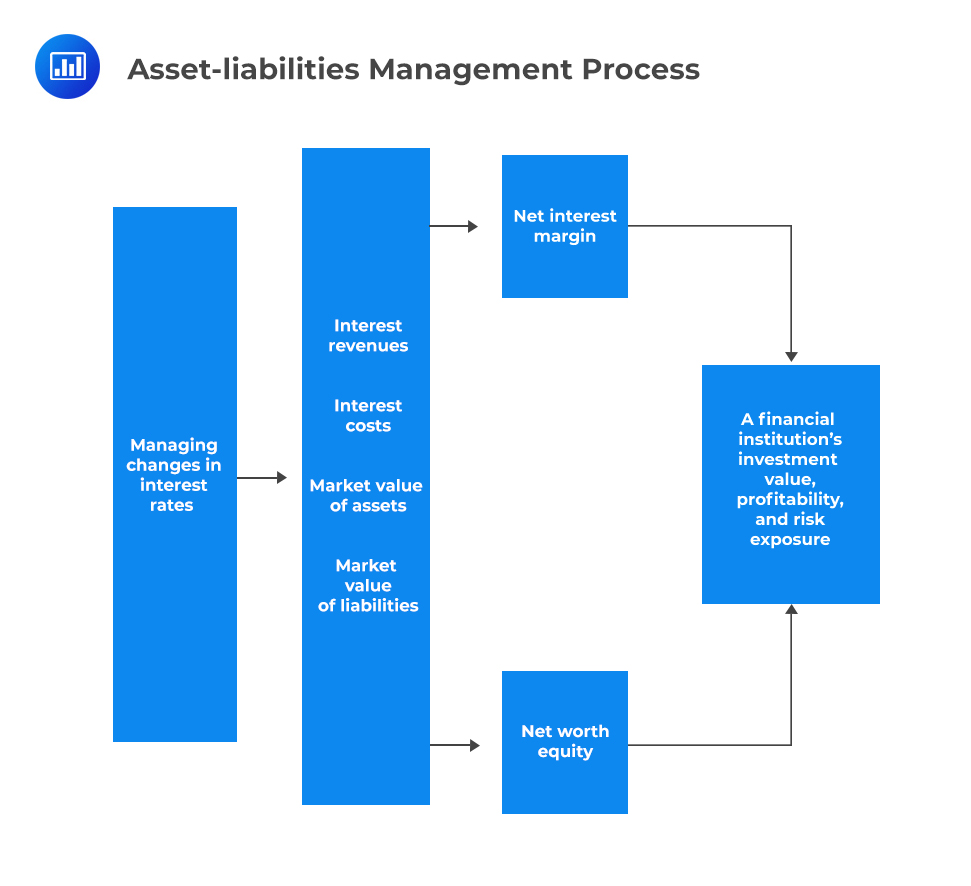

Risk Management for Changing Interest Rates Asset-Liability Management-and-Duration Techniques| AnalystPrep - FRM Part 2 Exam

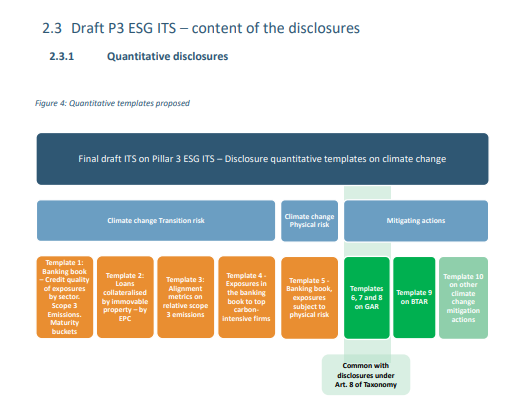

ESG risk disclosures for banks | The path to transparency, Alex Spooner, Simon Brennan, Esther Rawling

:max_bytes(150000):strip_icc()/final235-040b20455a3e4238929d2af40b5fa860.jpg)